By Noah Ocheni, Lokoja

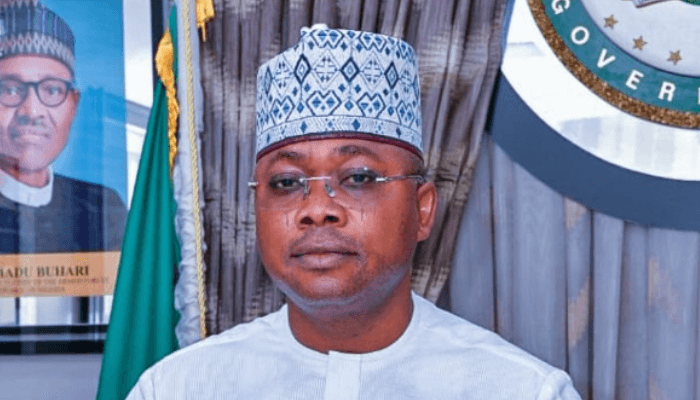

The Special Adviser on Revenue to Kogi State Governor, Dr. Rahman Nasir Ichanyi, has commended the management and staff of the Kogi State Internal Revenue Service (KGIRS) for their professionalism, dedication, and proactive engagement with stakeholders ahead of the implementation of the 2025 Tax Acts in the state.Dr. Ichanyi gave the commendation on Wednesday in Lokoja during a sensitisation programme on the 2025 Tax Acts, which are to be domesticated and implemented in Kogi State by KGIRS.He said the active participation of the KGIRS Chairman and Directors of Finance from various Ministries, Departments, and Agencies (MDAs) reflected a collective commitment to strengthening tax administration and promoting voluntary compliance across the state. According to him, stakeholder collaboration is critical to ensuring the smooth implementation of the 2025 Tax Acts and achieving the desired reforms in revenue generation and fiscal governance.“

I wish to specially appreciate His Excellency, the Executive Governor of Kogi State, Alhaji Ahmed Usman Ododo, for his visionary leadership and steadfast support in ensuring the effective domestication and implementation of progressive federal fiscal policies,” Ichanyi said. He added that Governor Ododo’s commitment to good governance and economic reforms continues to enhance fiscal discipline and promote sustainable development in Kogi State. Dr. Ichanyi explained that the 2025 Tax Acts, when domesticated, are distinguished by their simplicity, clarity, and taxpayer-friendly provisions, designed to improve compliance and ease the burden on businesses and individuals. He noted that the new tax framework harmonises tax obligations, eliminates multiple taxation, and provides clear operational guidelines that make compliance easier for taxpayers across sectors.“ The law also embraces technology-driven processes that improve efficiency, reduce human interference, and promote transparency and accountability in tax administration,” he said.

The Special Adviser further explained that the domesticated 2025 Tax Acts would deliver significant benefits to taxpayers by lowering compliance costs, ensuring fairness and equity, and fostering a more predictable and business-friendly tax environment. According to him, these reforms are expected to strengthen trust between the government and taxpayers, while ensuring that revenue generated translates into improved public services and infrastructure development across the state. Dr. Ichanyi stressed that effective implementation of the 2025 Tax Acts would play a critical role in supporting the state’s development agenda and long-term economic stability.

He therefore urged MDAs, private sector stakeholders, and other relevant institutions to support KGIRS in implementing the new tax regime and to act as ambassadors of tax compliance within their respective organisations.“ Together, we can build a robust and sustainable revenue system that will drive inclusive growth and development for Kogi State,” he said.The sensitisation programme formed part of KGIRS’ broader efforts to educate stakeholders on the provisions of the 2025 Tax Acts and prepare MDAs for their roles in the implementation process ahead of the January 2026 commencement date.

Leave a Reply