Sterling Bank and several of its senior executives have filed a lawsuit against the House of Representatives, accusing the legislative body of overstepping its constitutional authority by investigating matters already settled by a court ruling.

Justice Daniel Osiagor of the Federal High Court in Lagos has scheduled the hearing for July 18, 2025, to consider the constitutional challenge brought by Sterling Bank Limited, its parent company Sterling Financial Holdings Plc, and top officials Yemi Odubiyi, Abubakar Suleiman, Lekan Olakunle, and Dele Faseemo.

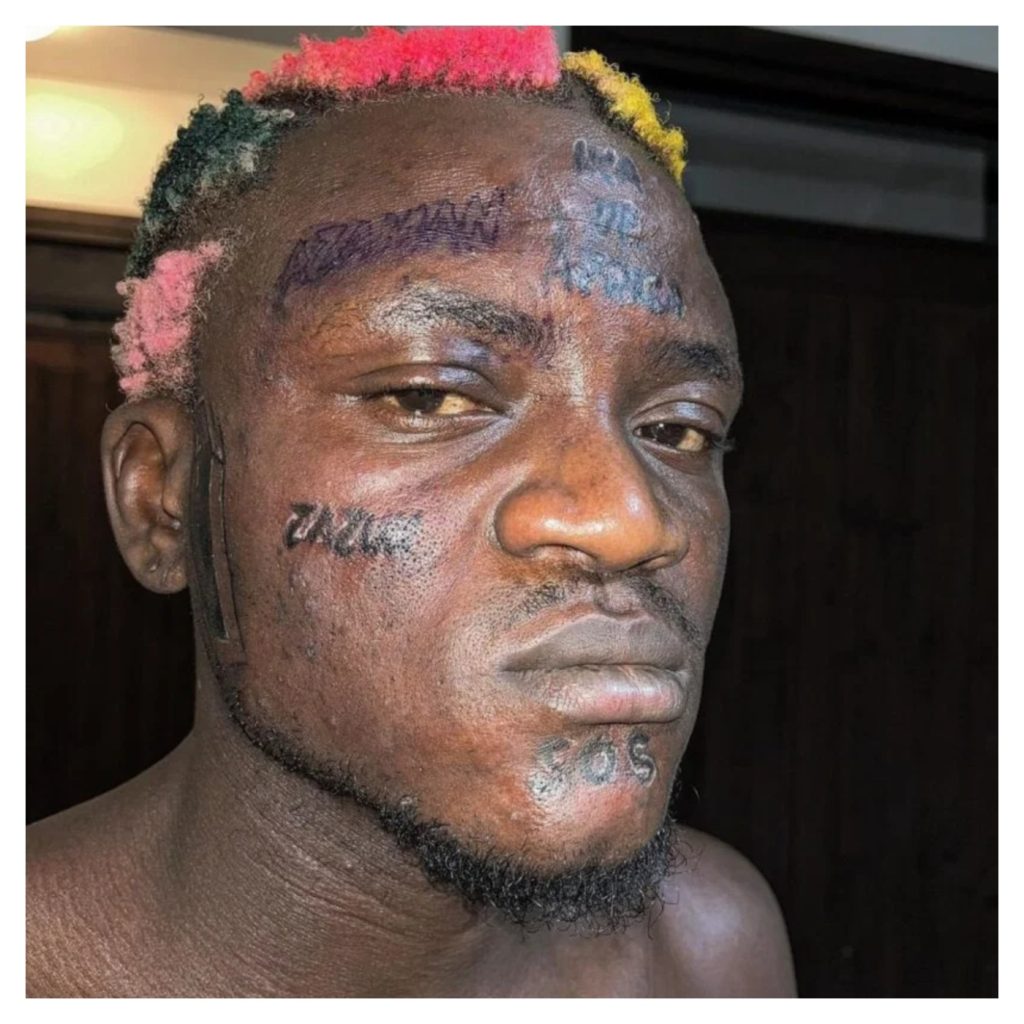

The legal action follows a probe initiated by the House’s Public Petitions Committee, chaired by Hon. Michael Etiaba, into a police report alleging financial misconduct in Sterling Bank’s handling of accounts belonging to Miden Systems Limited and its owner, Dr. Innocent Usoro.

In the suit, filed by human rights lawyer Femi Falana, SAN, the plaintiffs argue that the National Assembly lacks the authority under Sections 88 and 89 of the 1999 Constitution to investigate private banking transactions or revisit issues that were resolved through a 2021 consent judgment. They are seeking a perpetual injunction to stop the House from further action on the matter.

The plaintiffs also claim the legislature is using its oversight powers to relitigate settled judicial matters, violating the separation of powers, and undermining the judiciary. They contend that summoning bank executives amounts to abuse of legislative privilege.

Responding on behalf of the House, lawyer Rowland Osinachi Uzoechi dismissed the suit as an attempt to evade oversight and accountability. He argued that the claims are speculative and that the court has no jurisdiction over the matter.

Adding to the complexity, Dr. Usoro filed a counter-affidavit accusing Sterling Bank of falsifying documents to support what he claims is a fictitious $30 million loan. He said he was in the U.S. when the loan documents were allegedly signed, and that forged signatures and fake board resolutions were used to secure a Mareva injunction.

Usoro also pointed to a January 2025 police report that uncovered suspicious inflows of over $122 million into Miden Systems’ accounts, reinforcing his allegations of fraud and forgery.

Sterling Bank has denied all accusations, insisting that the loan was legitimate and tied to a 2010 contract with Shell Petroleum Development Company, executed by Miden Systems.

The Federal High Court is set to hear the case on July 18, 2025.