The Central Bank of Nigeria (CBN) has clarified that its e-Naira initiative is not aimed at competing with the digital payment services offered by commercial banks, contrary to popular belief.

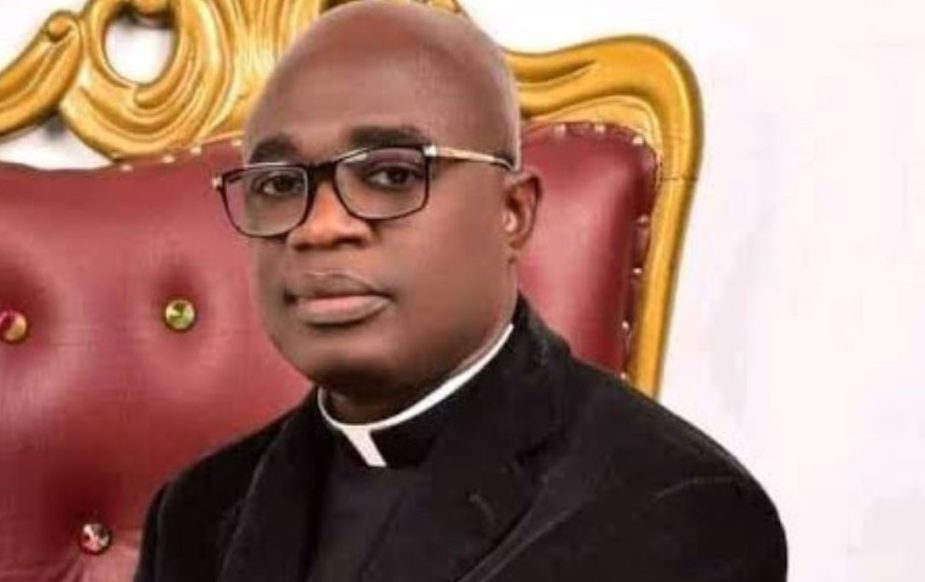

During an e-Naira sensitization forum held at the University of Abuja, Mr. Joseph Angaye, a Deputy Director of the CBN, emphasized that the e-Naira is not a replacement for the existing payment system or the Nigerian currency itself. Rather, it was introduced to enhance and strengthen the financial system, particularly the payment infrastructure, by addressing certain challenges and complementing the current framework.

Angaye stated, “We are not introducing it to be a competitor to what the banks are doing or other service providers, but to provide a platform they can leverage to offer more efficient services. We understand that some users have encountered challenges with the existing payment system, and the e-Naira will help promote financial inclusion, reduce congestion in the infrastructure, eliminate downtime associated with multiple interfaces for transactions, and even enable payment facilitation in areas with no network coverage.”

In addition, Angaye highlighted the CBN’s efforts to promote eNaira adoption in tertiary institutions across the country and create an environment where it becomes the preferred option for transactions. He mentioned that the CBN has engaged with various universities to educate them about the e-Naira and collaborate to ensure its integration as a means of financial transactions, particularly for revenue collection and payments.

Prof. Aisha Maikudi, Deputy Vice Chancellor of UniAbuja, expressed the university’s willingness to partner with the CBN in educating students and the wider Nigerian population about the e-Naira initiative.

Angaye further noted the evolution of the e-Naira since its inauguration by the former president almost two years ago, highlighting the achievements and improvements made based on feedback from stakeholders.