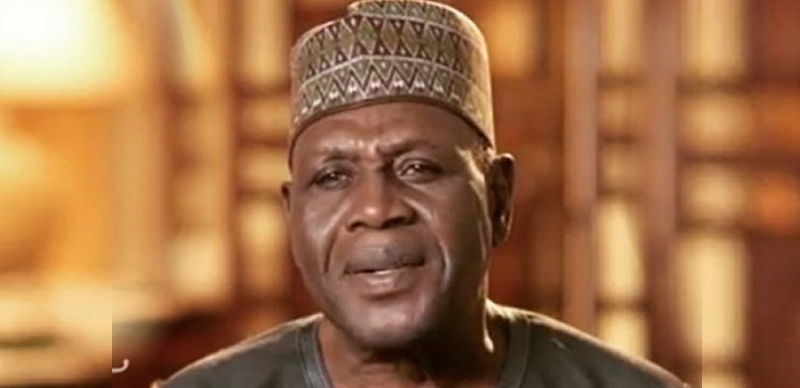

Aliko Dangote, the President of Dangote Group, is reportedly strategizing to establish an oil trading firm based in London to oversee crude and product supply for his newly built refinery in Lagos, Nigeria.

Six sources familiar with the matter revealed to Reuters on Tuesday that Dangote’s ambitious plan for the massive 650,000 barrel-per-day refinery has attracted keen interest from the global oil and fuel trading community.

The Dangote Petroleum Refinery, unveiled in Ibeju-Lekki, Lagos on May 22, 2023, is poised to reshape global oil and fuel flows, according to reports.

Dangote’s move is expected to diminish the influence of major trading firms such as BP, Trafigura, and Vitol, which have been engaged in negotiations for months, offering financing and crude oil in exchange for product exports from the refinery.

Despite Dangote’s estimated wealth of $12.7 billion by Forbes, he has not responded to multiple requests for comments from Reuters.

Trading sources disclosed that BP, Trafigura, Vitol, and other firms have engaged with Dangote both in Lagos and London to provide loans totaling approximately $3 billion in working capital required for the refinery to procure significant quantities of crude oil. However, no agreements have been reached thus far, as Dangote is concerned about losing control over the project and potential profit reduction.

In his quest for financial resources and crude supply, Dangote has also engaged with state-backed firms.

An industry source informed Reuters that Dangote intends to manage the venture independently.

Reports indicate that the newly formed trading team will be led by Radha Mohan, a former Essar trader who joined Dangote in 2021 as the director of international supply and trading.

Furthermore, the trading team is reportedly in the process of hiring two additional traders.

The Lagos refinery, which incurred costs of $20 billion, exceeding the initial budget by $6 billion, took nearly a decade to complete. While it has begun refining operations, it will take several months to reach full capacity.

Vitol and Trafigura have reportedly taken various steps to support the refinery’s crude procurement, with Vitol prepaying for some product cargoes and Trafigura exchanging crude oil for future fuel cargoes. However, both companies declined to comment on these arrangements.