By Ibrahim Muhammad, National Coordinator, Independent Hajj Reporters

The ongoing pilgrimage registration in Nigeria is witnessing the lowest participation rate in the history of Hajj seat reservations, largely due to the N8.4 million deposit benchmark set by the state Muslim Pilgrims Welfare Boards. This surge in Hajj fare has dampened the enthusiasm of many average Nigerian Muslims, making it more challenging for them to participate in the pilgrimage.

The annual increase in Hajj fares calls for innovative solutions that require serious commitment from Hajj administrators and service providers. While the fare hike affects all countries participating in Hajj, some nations have introduced creative policies to ease the financial burden on their pilgrims. It is time for Nigeria to consider adopting similar approaches.

International Approaches to Reducing Hajj Costs

Countries like Pakistan and Malaysia have rolled out creative measures to manage Hajj fares. Pakistan’s approach includes determining Hajj fares based on accommodation locations, while allowing citizens abroad to pay in dollars. Meanwhile, Malaysia has signed three-year airlift agreements to reduce Hajj package prices, and Tambug Hajji has subsidized packages for its pilgrims.

NAHCON’s Efforts

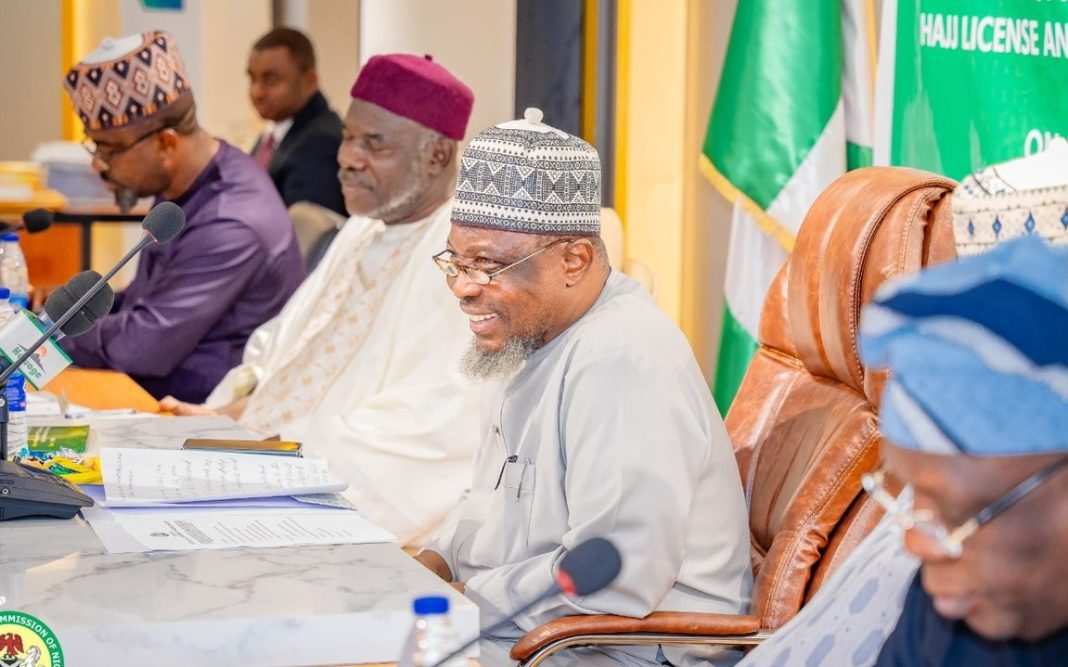

In Nigeria, the Chairman of the National Hajj Commission of Nigeria (NAHCON), Professor Usman Abdullahi Saleh, is focused on reducing Hajj fares. He has already introduced experimental measures that may lower the 2025 Hajj fare compared to 2024. However, the first step towards achieving this goal is to negotiate service costs with providers, focusing exclusively on the interests of pilgrims.

Though NAHCON cannot control the exchange rate, it can negotiate service prices and influence the duration of the stay in Saudi Arabia. Unfortunately, the duration of stay is often dictated by the regulations of the Saudi General Civil Aviation Authority (GACA), which oversees the airlift of pilgrims.

GACA Regulations and Their Impact on Nigeria

The GACA rules govern flight scheduling, with the distribution of flights over a span of 30 days. This means that Nigeria’s allocation of 95,000 seats necessitates a 30-day airlift spread, resulting in each batch of pilgrims spending a minimum of 30 days in Saudi Arabia. Private Hajj operators, however, can offer shorter packages of 2 weeks or 20 days, while state pilgrims are typically bound by the 30-day rule.

Innovative Approaches to Hajj Fare Reduction

NAHCON should consider alternative Hajj packages that differ from the existing three categories. Currently, the State Muslim Pilgrims Welfare Boards offer three categories of packages with varying amounts for Basic Travelling Allowance (BTA), ranging from $750 to $1,500. It is time to introduce more flexible options.

Alternative packages could include:

- A Hajj fare with no BTA

- A Hajj fare with a $300 BTA

- A Hajj fare with a $500 BTA

- A Hajj fare with a $800 BTA

Another potential option is to offer shorter stays in Saudi Arabia, without violating GACA’s airlift regulations. This could involve shorter stays in Makkah or Madinah, which would, in turn, reduce accommodation costs. These options could give Nigerian pilgrims more control over their travel experience and expenses.

Long-Term Contracts to Lower Service Costs

NAHCON can leverage long-term contracts approved by the Saudi Ministry of Hajj and Umrah to lower accommodation and catering costs. For example, by securing three-year retainership deals with caterers and accommodation providers, NAHCON could negotiate lower rates for food and lodging. If caterers charge 50 Saudi Riyals per plate, a long-term contract could potentially reduce this cost to 35 Saudi Riyals.

Stability in the Hajj Industry

The instability in Nigeria’s Hajj industry can largely be attributed to the annual signing of contracts with service providers. By signing long-term contracts, NAHCON can help stabilize the sector, reduce costs, and ensure that services remain consistent over multiple years.

The Hajj Saving Scheme and License Renewal Reforms

The Hajj Saving Scheme (HSS) could also play a significant role in reducing financial pressures. However, Nigeria’s internal structure and political dynamics may complicate its implementation.

Additionally, NAHCON should consider abolishing the yearly renewal of operational licenses for private Hajj and Umrah operators. Instead, a three-year license period would provide operators with greater stability and encourage them to devise long-term plans, potentially lowering the cost of private Hajj packages.

Experimenting with Short-Stay Packages

NAHCON could experiment with short-stay options for a small percentage of pilgrims, such as 15-20% of State Hajj seats. Pilgrims opting for shorter stays could receive lower-cost packages with fewer services, such as no provision for feeding in Makkah and Madinah. These pilgrims could also have a shortened stay in Madinah, which would reduce accommodation costs.

These short-stay pilgrims could be identified with a unique NAHCON-designed card. A separate airline could be dedicated to their airlift, with flights scheduled 12 days before Arafat and returning 6 days after Hajj, which would help minimize accommodation fees.

Currency Swap Deal with Saudi Arabia

Lastly, Nigeria could explore entering into a currency swap agreement with Saudi Arabia, similar to the recent arrangement between Nigeria and China. This would enable Nigerian pilgrims to pay for services in Naira, potentially lowering the cost of Hajj for Nigerian citizens.

Conclusion

Reducing the cost of Hajj fare in Nigeria requires innovative and strategic thinking. By exploring options like flexible packages, long-term service contracts, and a currency swap agreement, NAHCON can alleviate the financial burden on pilgrims and make Hajj more accessible to Nigerian Muslims.