By Achadu Gabriel, Kaduna

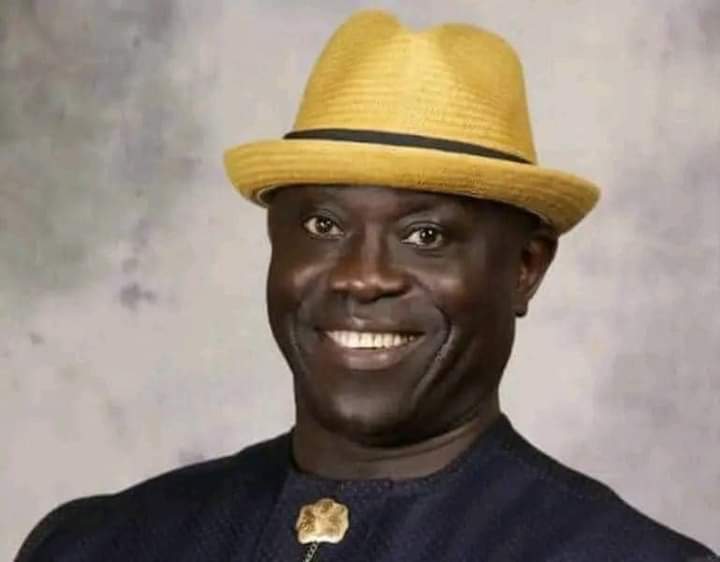

Kaduna state Governor, Senator Uba Sani on Tuesday signed first Executive Order on financial inclusion, a statement personality signed by the Governor has revealed.

The statement stressed that the signing is pursuant to the State Government’s efforts to address the exclusion of about 2.1 million poor, underserved and vulnerable citizens in the rural areas from financial services in Kaduna State and to ensure they benefit from the State and Federal Government’s Social Intervention Programmes.

“History was made today as I signed my first Executive Order on “Financial Inclusion in Kaduna State”, he stated.

He also stated that “In exercise of the powers conferred on me by Section 5 (2) of the Constitution of the Federal Republic of Nigeria (as amended) and all other powers enabling me in that behalf, I made the orders 1- 8”.

His words: “A Financial Inclusion and Literacy Committee is hereby constituted to fashion strategies and modalities to ensure the inclusion of the poor, underserved and vulnerable in Kaduna State, as well as equip them with financial skills to enable them make sound financial and investment decisions.

The statement added that “The target of the State Government is to include about 1million poor, underserved, unbanked and vulnerable citizens in the financial services sector in the next one year.

Others include “The State Government in collaboration with key stakeholders, including CSOs, NGOs and Financial Technology Companies (FINTECHS), will to develop a State Financial Inclusion Strategy.

“The State Government shall develop a state register of the Poor, Under-Served and Vulnerable. The Register will be subjected to various stages of integrity tests.

“The State Government shall work with banks and other financial service providers to open bank accounts for un-banked citizens, and embark on aggressive sensitization programme to ensure the mass participation of our citizens in this exercise.

“The State Government, in collaboration with regulatory agencies in the financial sector will organize Financial Literacy Workshops to equip citizens with financial skills that will enable them make sound financial and investment decisions.

“The State Government shall consult with key stakeholders like Traditional Rulers, Religious Leaders, Local Government Chairmen, Youth, Women and Community Development Associations to ensure the mass sensitization and involvement of the citizens in this financial inclusion drive”, it stated.

It also include “The Committee on Financial Inclusion and Literacy is hereby directed to liaise with all relevant Government Ministries, Departments and Agencies in ensuring the full implementation of this order”, respectively.