Recent reports indicate that nigerian banks have initiated the repayment of a ₦200 billion debt owed to telecom companies, as agreed upon in late 2023. This debt accrued from the use of unstructured supplementary service data (ussd) services provided by telecom firms, with payments beginning following the involvement of central bank of nigeria (cbn) governor olayemi cardoso.

However, concerns have been raised by gbenga adebayo, president of the association of licenced telecommunication operators of nigeria (alton), over the slow pace of these repayments. Adebayo emphasized that delays in payments could potentially increase the debt due to accrued interest, urging banks to expedite the process.

The dispute over ussd fees between telcos and banks has spanned six years, necessitating regulatory interventions from both the cbn and the nigerian communications commission. Some have speculated that the sluggish repayment may reflect lingering tensions between banks and telcos over fee-sharing disagreements.

In a related development, unnamed bank ceos have defended their stance, highlighting initial disagreements on ussd fee obligations and criticizing the transparency of billing processes initiated by telcos. Despite regulatory directives for banks to collect and remit ussd fees to telcos, ongoing delays in repayments suggest a broader friction in fee management between the two sectors.

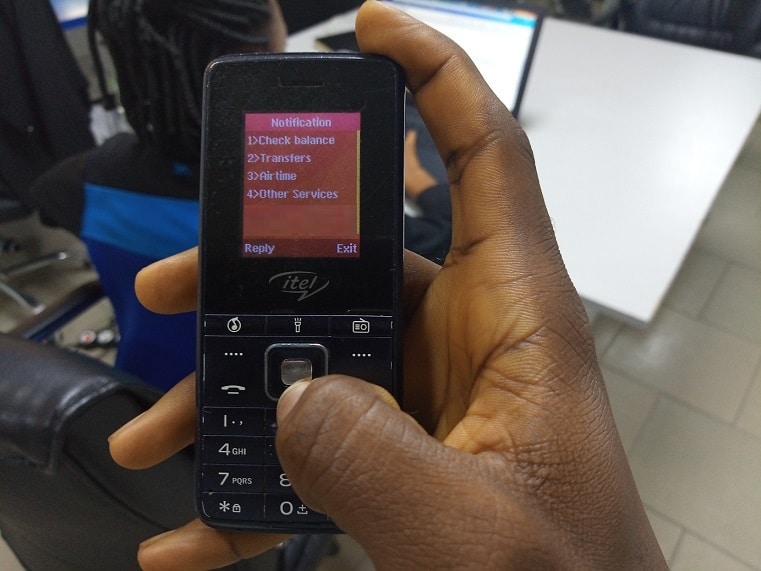

The ussd technology, originally intended for airtime and subscription services, gained popularity in banking due to its accessibility without requiring internet or smartphones. Recent regulatory actions, including approvals for potential disconnections and calls for standardized transaction codes, underscore the complexities surrounding ussd fee management in nigeria.