By Daniel Edu

The Presidential Committee on Tax Policy and Fiscal Reforms is considering a significant change in revenue collection practices. The Nigeria Customs Service and 62 other Ministries, Departments, and Agencies (MDAs) of the Federal Government might soon cease direct revenue collection responsibilities.

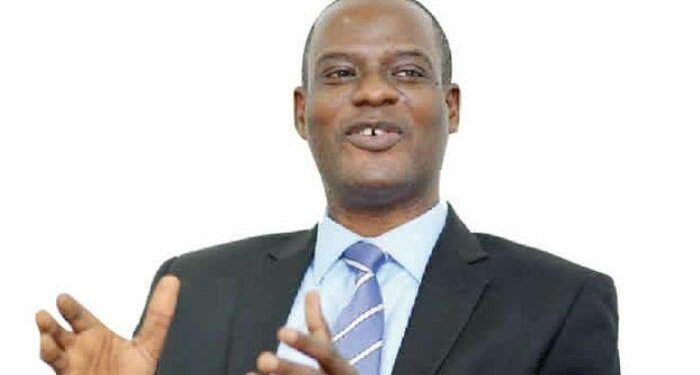

The committee suggests that the Federal Inland Revenue Service (FIRS) will take over revenue collection for these MDAs. The committee’s Chairman, Taiwo Oyedele, shared this information during an appearance on Channels Television’s Sunrise Daily breakfast show on Wednesday.

President Bola Tinubu recently inaugurated the tax reforms committee, which boasts diverse membership, including Orire Agbaje, a 400-level Economics student from the University of Ibadan (UI).

Oyedele explained that the current setup poses challenges, leading to high collection costs and inefficiencies. The MDAs, originally intended for specific functions, become sidetracked when tasked with revenue collection. By transferring revenue collection to the FIRS, benefits such as improved efficiency, reduced collection costs, and enhanced focus on core functions are expected.

Oyedele, a former Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers (PwC), emphasized that MDAs should concentrate on their primary responsibilities. For instance, Customs should focus on trade facilitation and border protection, while regulatory bodies like the Nigerian Communications Commission (NCC) should focus solely on telecommunications regulation.

The proposed shift is envisioned to bring transparency and accountability to revenue collection, as it becomes clearer how collected funds are allocated and utilized.

In the larger context of Nigeria’s tax landscape, Oyedele highlighted a substantial tax gap estimated at around 20 trillion naira. The focus on key taxes like Value Added Tax, Corporate Income Tax, and Personal Income Tax is necessary due to non-compliance, particularly within the middle class and elite segments. Some individuals pay significantly lower taxes than their obligations, highlighting the need for more robust tax enforcement and collection mechanisms.