Rivers State Governor, Nyesom Wike, has ordered the Rivers State Revenue Service (RSRS) to fully implement the State Value-Added Tax Law 2021 which he assented to recently.

This follows the failure of the Federal Inland Revenue Service (FIRS) to stop the state government from collecting VAT, having filed an application at a Federal High Court in Port Harcourt, the state capital.

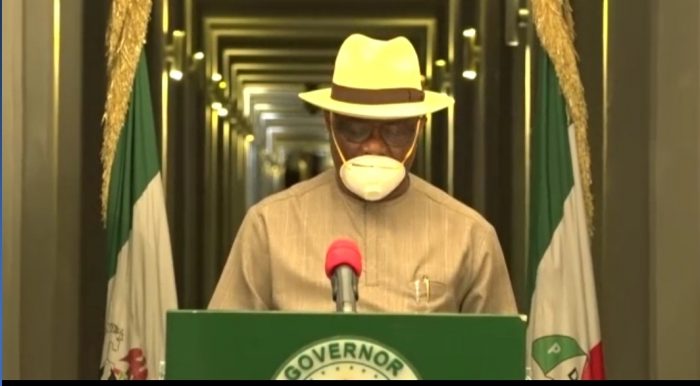

“With today (Monday’s) judgement, the way is now clear for the administration and enforcement of the Rivers State Value-Added Tax Law 2021 across the entire state until otherwise decided and set aside by the superior courts,” the governor said in a statewide broadcast on Monday, hours after the court refused the suit by FIRS.

“Consequently, I hereby direct the Rivers State Revenue Service (RSRS) to ensure the full and total implementation and enforcement of this law against all corporate bodies, business entities, and individuals with immediate effect.

“Let me warn that the Rivers State government is fully in charge of the state and will not tolerate any further attempt by the FIRS to sabotage or undermine our authority to freely administer our tax and other related laws in our own state. Those who play with fire risk having their fingers burnt; enough of the shenanigans.”

Governor Wike also directed all corporate bodies, business entities, and individuals in Rivers to willingly, truthfully and promptly comply with their tax obligations under the law.

He warned that those who fail in such responsibilities risk sanctions, including having their business premises sealed up by the government.

The governor assured residents that his administration would effectively use the expected proceeds from the collected tax to accelerate the development of the state and improve their well being.

He explained that the enactment of the VAT law followed a recent judgement of the court that upheld the constitutional right and authority of state governments to impose, collect, and utilise VAT within their respective territorial jurisdictions.

“As expected, the Federal Government, through the Federal Inland Revenue Service (FIRS), disagreed and filed an appeal coupled with a request for stay-of-execution of the judgment before the Federal High Court.

“While the appeal was pending and without any stay-of-execution of the subsisting judgement, the FIRS went about to bully corporate bodies and business entities from paying the VAT to the Rivers State government, even when they knew that an appeal does not serve as a stay, neither was there anything to stay in a declaratory judgement,” Governor Wike said.

“As a mere agency of the Federal Government without any political authority, the effrontery and impunity exhibited by the FIRS against the Rivers State government were ill-advised and highly provocative.”

He stated that the government had decided to suspend the enforcement of the VAT Law pending the outcome of the FIRS’s application for stay-of-execution.

According to the governor, the state did no wrong in exercising its legal right under a constitutional democracy to stop the continuing breach, denial, and curtailment of the constitutional right of states to lawfully impose and collect value-added and other related taxes within their jurisdiction.

He said the objective of such action was to contribute to the advancement of fiscal federalism by enabling the federating states to explore their potential and capacity for generating greater internal revenues.

Governor Wike, however, admitted that some states with presently low economic activities and ethically restrictive social policies with economic implications may be adversely affected for now.

“Above all, fiscal federalism remains the right path to economic self-reliance and sustainability for all our states and the benefits derivable from this case by all the states in the long run far outweigh the immediate revenue loss that some states may presently suffer,” he said.

Prior to the governor’s broadcast, Justice Stephen Dalyop Pam refused the application by FIRS, seeking to stop the Rivers State government from collecting VAT.

He held that the revenue agency failed to file an application to set aside the tax law recently enacted by the Rivers State House of Assembly and signed by Governor Wike on August 19, therefore, the state law on VAT was valid and subsisting.