The Centre for Energy Governance and Public Finance Accountability (CEGPFA) has dismissed claims by the African Democratic Congress (ADC) that President Bola Ahmed Tinubu’s approval of the reconciliation and removal of certain Nigerian National Petroleum Company Limited (NNPC Ltd) legacy balances from the Federation Account was unconstitutional or financially harmful to states and local governments.

Speaking on Friday at a press conference held at the Transcorp Hilton, Abuja, the centre said the allegations ignored the historical, legal and fiscal realities surrounding the disputed balances, describing them as “unfounded” and “misleading”.

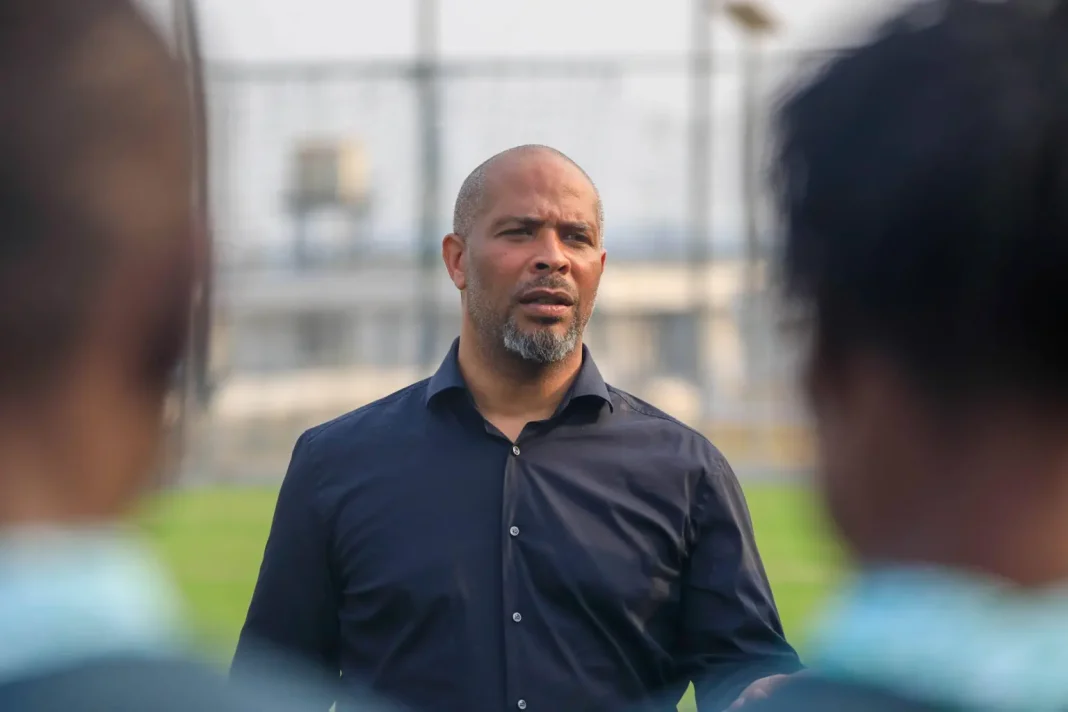

Dr Julius Osagie Eromonsele, executive director of the centre, said the balances in question were not fresh revenues generated under the current administration but long-standing legacy entries accumulated over several decades, many of which predated the Petroleum Industry Act (PIA).

“It is crucial to note that the balances in question are not recent revenues generated under the current administration. They are long-standing legacy entries accumulated over decades, many of them arising before the enactment of the Petroleum Industry Act,” Eromonsele said.

He explained that the disputed figures stemmed from unresolved production sharing contract disputes, domestic crude supply obligations under the former fuel subsidy regime, royalty assessment disagreements and reconciliation gaps between NNPC, regulators and revenue agencies.

According to him, these balances had remained on the Federation Account books for years despite repeated audits that questioned their accuracy, legal enforceability and collectability, creating a distorted picture of public finances across all tiers of government.

Countering claims that the balances were arbitrarily written off by presidential fiat, Eromonsele said the approval followed a formal reconciliation process involving relevant fiscal and regulatory institutions, with presentations made to the Federation Account Allocation Committee (FAAC).

“Official records show that approximately $1.42 billion and N5.57 trillion were removed from the Federation Account books after reconciliation established that these figures were either duplicated, overstated, unsupported by verifiable documentation, or no longer legally recoverable,” he said.

He stressed that the directive applied strictly to legacy balances accumulated up to December 31, 2024, adding that reconciliation should not be confused with the cancellation of valid revenue.

“Reconciliation is a recognised public finance practice. It is not the same as cancelling valid revenues. Rather, it is the process of aligning records to reflect economic and legal reality,” Eromonsele said.

He also clarified that no cash was removed from the Federation Account and that no allocations to states or local governments were reversed.

“The funds in question were not sitting as cash in the Federation Account. What occurred was the correction of inherited accounting distortions that had long outlived their practical relevance,” he added.

Addressing constitutional concerns raised by the ADC, the centre said Section 162 of the Constitution applies only to revenues that are lawfully due and payable, not to disputed or extinguished claims.

“Public finance administration requires constant reconciliation to ensure that only valid, auditable and legally enforceable revenues are presented for distribution,” Eromonsele said.

He argued that sustaining false receivables undermines budgeting, fiscal discipline and revenue predictability for subnational governments, noting that credible and realistic revenue flows are more beneficial than inflated figures that never materialise.

The centre said the reconciliation aligns with reforms introduced by the PIA, which repositioned NNPC Ltd as a commercial entity operating under international accounting standards.

Concluding, the centre commended President Tinubu for approving what it described as a difficult but necessary decision.

“Writing off long-standing, unverifiable legacy balances required political will and a commitment to fiscal honesty over convenience. It sends a clear signal that Nigeria is prepared to confront the structural weaknesses of its energy revenue system rather than perpetuate them,” Eromonsele said.

He urged politicians and stakeholders to approach the issue responsibly and support reforms that strengthen transparency and accountability in Nigeria’s public finance system.

Full speech attached

BEING FULL TEXT AT A PRESS CONFERENCE ORGANISED BY THE CENTRE FOR ENERGY GOVERNANCE AND PUBLIC FINANCE ACCOUNTABILITY ON THE RECONCILIATION OF NNPC LTD LEGACY BALANCES AND THE FEDERATION ACCOUNT HELD AT TRANSCORP HILTON, ABUJA, ON FRIDAY, JANUARY 10, 2025

Ladies and gentlemen of the press, distinguished stakeholders, and fellow Nigerians, the Centre for Energy Governance and Public Finance Accountability has convened this important press conference to respond to unfounded claims by the African Democratic Congress (ADC) concerning President Bola Ahmed Tinubu’s approval of the reconciliation and removal of certain legacy balances attributed to the Nigerian National Petroleum Company Limited (NNPC Ltd) from the Federation Account.

The debate has been framed as a constitutional crisis and a deliberate deprivation of revenue due to states and local governments. Given the gravity of such allegations, it is important to ground this conversation in facts, law, and the historical context of Nigeria’s petroleum revenue administration.

BACKGROUND

It is crucial to note that the balances in question are not recent revenues generated under the current administration. They are long-standing legacy entries accumulated over decades, many of them arising before the enactment of the Petroleum Industry Act (PIA). These entries stem from unresolved production sharing contract disputes, domestic crude supply obligations under the fuel subsidy regime, royalty assessment disagreements, and persistent reconciliation gaps between NNPC, regulators, and revenue agencies.

For years, these balances remained on the Federation Account books despite repeated audits and reviews that questioned their accuracy, legal enforceability, and collectability. Treating such disputed figures as assured income created a distorted picture of public finances and fostered unrealistic revenue expectations across all tiers of government.

WHAT THE PRESIDENTIAL APPROVAL ACTUALLY MEANS

Contrary to claims of an arbitrary executive write-off, the President’s approval followed a formal reconciliation process involving relevant fiscal and regulatory institutions, including presentations made to the Federation Account Allocation Committee (FAAC).

Official records show that approximately $1.42 billion and N5.57 trillion were removed from the Federation Account books after reconciliation established that these figures were either duplicated, overstated, unsupported by verifiable documentation, or no longer legally recoverable. The directive applied strictly to legacy balances accumulated up to December 31, 2024.

Reconciliation is a recognised public finance practice. It is not the same as cancelling valid revenues. Rather, it is the process of aligning records to reflect economic and legal reality. Revenues that are not collectible cannot be distributed, and carrying them indefinitely on public accounts does not create wealth—it merely postpones fiscal clarity.

It is also critical to note that the funds in question were not sitting as cash in the Federation Account. No existing allocations to states or local governments were reversed or withdrawn. What occurred was the correction of inherited accounting distortions that had long outlived their practical relevance.

CONSTITUTIONAL AND FISCAL IMPLICATIONS

The ADC has cited Section 162 of the Constitution to argue that the President lacks authority to approve the removal of these balances. However, Section 162 applies to revenues that are lawfully due and payable to the Federation. It does not compel the perpetuation of disputed or legally extinguished claims as revenue.

Public finance administration requires constant reconciliation to ensure that only valid, auditable, and legally enforceable revenues are presented for distribution. Without this, the Federation Account would become a repository for accounting fiction rather than a transparent reflection of national income.

Furthermore, the Federation Account is administered collectively through FAAC, which includes representatives of the federal, state, and local governments. The reconciliation process was not unilateral, secretive, or detached from institutional oversight.

From a fiscal standpoint, sustaining false receivables undermines planning, budgeting, and fiscal discipline. States and local governments are better served by predictable, credible revenue flows than by inflated figures that repeatedly fail verification and never materialise in cash form.

This reconciliation also aligns with the reforms introduced by the Petroleum Industry Act, which repositioned NNPC Ltd as a commercial entity subject to international accounting standards. Legacy balances accumulated under a fundamentally different governance structure cannot be allowed to distort the post-PIA fiscal framework indefinitely.

CONCLUSION

In conclusion, the Centre for Energy Governance and Public Finance Accountability affirms that the reconciliation and removal of NNPC Ltd’s legacy balances from the Federation Account does not constitute a constitutional violation, nor does it deprive states and local governments of legitimate revenue.

Rather, it represents a necessary and responsible step toward restoring transparency, credibility, and realism to Nigeria’s public finance system—particularly in the oil and gas sector, which has long suffered from opaque accounting and inherited distortions.

The Centre acknowledges and commends President Bola Ahmed Tinubu for approving this difficult but necessary decision. Writing off long-standing, unverifiable legacy balances required political will and a commitment to fiscal honesty over convenience. It sends a clear signal that Nigeria is prepared to confront the structural weaknesses of its energy revenue system rather than perpetuate them.

True fiscal federalism cannot be built on numbers that exist only on paper. It must rest on transparent accounts, enforceable obligations, and a shared commitment to accuracy and accountability.

We urge all politicians and stakeholders to approach this issue with responsibility and restraint, and to support reforms that strengthen, not weaken, the integrity of Nigeria’s public finances.

Thank you.

[Questions]

Signed:

Dr Julius Osagie Eromonsele

Executive Director,

Centre for Energy Governance and Public Finance Accountability