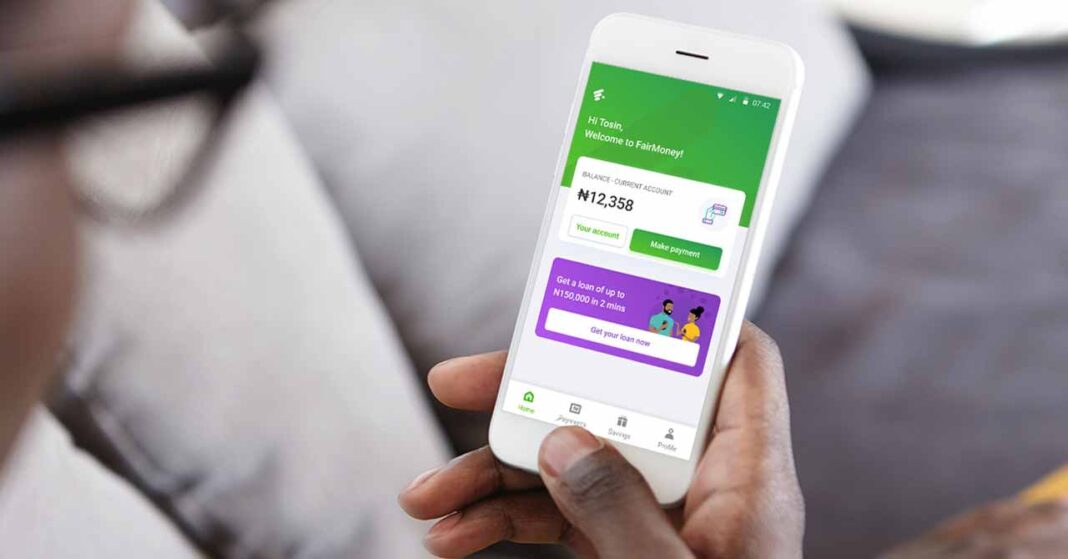

There is something different about lying down on your couch, a phone in your hands, starting and completing any banking transactions without having to set foot in any bank’s premises. It is the ultimate convenience that new financial services providers known as digital banks are trying to deliver.

On Friday, one more fintech company, Fairmoney received $42 million in Series B to transform itself from just a loan company into a digital bank.

The funding round was led by Tiger Global Management, a US hedge fund, and investment firm. The company co-led the $170 million investment in Flutterwave earlier in March. That funding took the valuation of Flutterwave to $1 billion making it the second fintech unicorn after Interswitch.

Participation in the funding also came from Flourish Ventures, Newfund, partners of DST Global, and Speedinvest.

Founded in 2017, Fairmoney provides small loans from N1,500 to N500,000 ranging from days to six months to people. It currently has 3.5 million registered users with 1.3 million being unique bank account holders, according to TechCrunch. The company plans to deploy $300 million in loans before the end of the year.

While expanding its loan offering is exciting, it is the new chapter of Fairmoney as a digital bank that is most remarkable.

“The ambition is that by the end of the year, the customer has the full-fledged banking experience from P2P transfers and lending to debit cards and current accounts,” said Laurin Hainy, CEO of Fairmoney. “In addition to that, we are working on a number of additional savings products, stock trading, and crypto-trading products potentially depending on where regulation is heading.”

A digital bank describes an organisation that can offer banking activities online that were historically only available at a bank branch.

In that sense, services a digital bank conducts online include money deposits, withdrawals, and transfers; checking/saving account management; applying for financial products; loan management; paying bills/invoices; and account services.

Essentially, a digital bank should be able to provide all the banking functions that have once been exclusive at bank head offices, branches, and via bank cards at ATM machines.

In Nigeria, digital banks have evolved from the days of ATMs to USSDs, online and web payments, and mobile money. The adoption of digital banking is evolving alongside. In 2019, the country saw over 370 million mobile money transactions from 15.3 million customers.

The growing adoption is mainly driven by Nigeria’s robust mobile penetration, the largest on the continent. Broadband penetration may not be growing at 39 percent of May 2021, but digital bank operators are learning to include non-internet dependent channels like USSDs and SMS to get their services across to the end-users. Still, most of the services that digital banks provide depend on the internet.

Digital bank incumbents, Kuda Bank, Carbon, VBank, Fundall, Sparkle, Eyowo, and many others are bound to take notice of Fairmoney’s new ambitions. The digital banks’ adoption pie is not expansive enough yet, due to slow smartphone adoption at less than 35 percent. Players like Kuda Bank needed to adopt unique strategies to attract users. In the case of Kuda, it was ‘bank of the free’ in which it offered prospective users free transaction charges and ATM cards.

Fairmony would need its own strategy. Its loan segment has not been a smooth ride and the numbers it has achieved did not all come from users who were willing to repay loans.

Dwindling incomes mean that borrowers often are not eager to fulfill their loan obligation even though they risk a negative credit score. Loan defaults are rampant. Hence, in many cases, Fairmoney and several other loan providers have had to utilise unorthodox measures to get their money back. And the success rate looks like this; 60 percent of people who collect loans pay back and 80 percent of defaulters pay back because of the measures the loan providers give.

Being a digital bank now offers Fairmoney extra liquidity which then makes it possible to push loans to small businesses that have the ability to repay them. In this sense, Hainy says Fairmoney is focusing on registered SMEs in Nigeria.

Fairmoney has been planning for its digital banking transition way ahead of the funding round, securing a microfinance bank licence. Hainy says the MFB licence enables the company to open current accounts for users.

“And we’re doing that on a big scale. We opened accounts for our repeated and new customers, which I think is quite a unique company strategy because we don’t need to burn millions of dollars of customer acquisition cost on users like of other competitors. I think all of that has enabled us to become sort of the largest digital bank in Nigeria,” Hainy said.